Pnc Atm Deposit

3/25/2022 admin

- For deposit ATMs, the rules might be different, so call your bank and check the funds' availability policy for details. You can typically expect to have $200 or so available from a check deposit quickly, with the rest on hold, and available in several business days.

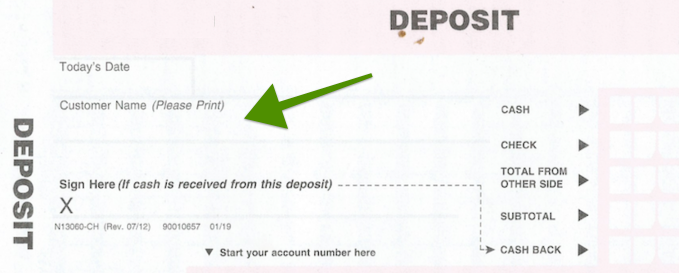

- PNC DepositEasy is the 'envelope-free' way to make cash or check deposits right at the ATM, any time of day or night, including weekends and holidays. 24/7, 365 days Make cash or check deposits 24/7, 365 days.

- PNC has the right banking products and financial expertise for individuals, small businesses, and large institutions. Choose PNC for checking accounts, credit cards, mortgages, investing, borrowing, asset management and more — all for the achiever in you.

The minimum deposit required to open the account is $25 at a PNC branch. To earn this Introductory Rate Offer ('Offer'), you must open a new Virtual Wallet with Performance Select Growth account* and maintain a minimum balance of $10,000.

Whether you deposit a check through the PNC Mobile app, at a PNC DepositEasy℠ ATM or with a teller, PNC Express Funds gives you the option, for a fee, to make the full amount available immediately for withdrawals and purchases Enjoy the convenience of PNC Express Funds when: You need immediate access to your deposited funds. We're excited to announce that our ATMs are being upgraded to be faster, easier to use, and envelope-free. Watch this video to see a demonstration of how to.

Click to see full answer.

Besides, what is a growth account in PNC?

Pnc Atm Deposit Near Me

We think it will help you understand your account better and provide insight into procedures at PNC that impact your account. Your Growth account is a savings account which earns interest and can be used for longer-term savings goals. These consumer accounts are for your personal, family or household use only.

Furthermore, is PNC Virtual Wallet a checking or savings account? Virtual Wallet is comprised of 3 accounts working together: Your Spend account is a non-interest-bearing checking account. Your Reserve account is an interest-bearing checking account used for short term savings goals.

Simply so, what do you need to open a bank account at PNC?

A. A valid U.S. address and Social Security number are required. You must be 18 years of age or older and will also need to provide a 2nd form of ID.

How long does it take to transfer money between PNC accounts?

However, international transfers take

transfers take longer, sent through ACH payments and can cost up to $45 – expensive for a

longer, sent through ACH payments and can cost up to $45 – expensive for a  money transfer service.

money transfer service.Details.

| Product Name | PNC Bank online money transfers |

|---|---|

| Transfer Speed Minimum transfer time | 3 - 5 days |

| Customer Service | Phone, Email, Branch |

PNC Bank is a subsidiary of Pittsburgh-based PNC Financial Services Group, one of the largest financial services institutions in the U.S., with assets of $445 billion. Its retail branch network sprawls out over 21 states in the Mid-Atlantic, Southeast and Midwest.

With approximately 2,400 branches and 18,000 fee-free ATMs, PNC Bank has a large physical presence. It also has a full array of online and mobile banking tools, making it a good fit for checking account customers who prefer traditional branch banking, online and mobile banking or a combination of the two.

PNC Bank’s main checking account offerings include: Virtual Wallet, for customers who want basic account features and online tools; Virtual Wallet Performance Spend, for those who want a broader banking relationship with some rewards; and Virtual Wallet Performance Select, which is the premium checking account with the highest level of rewards and benefits.

| Account name | APY | Minimum deposit | Monthly fee |

|---|---|---|---|

| Virtual Wallet | None | $0 online; $25 at a branch | $7 |

| Virtual Wallet with Performance Spend | 0.01% (on $2,000 or more) | $0 online; $25 at a branch | $15 |

| Virtual Wallet with Performance Select | 0.01% (on $2,ooo or more) | $25 | $25 |

Note: The APYs (Annual Percentage Yield) shown are as of Dec. 23, 2020.

PNC also offers Virtual Wallet Student, a non-interest bearing checking account with no balance requirement and no monthly service fee. The perks of this account are good for up to six years.

Here are more details about PNC’s main checking accounts.

- Virtual Wallet

- Virtual Wallet with Performance Spend

- Virtual Wallet with Performance Select

Virtual Wallet

Virtual Wallet is an umbrella title for a combination of checking and savings accounts. In this tier, the checking account, called Spend, is a basic, non-interest bearing account. Reserve is a short-term savings account and Growth is a long-term savings account. The Reserve and Growth accounts also serve as built-in overdraft protection.

The Reserve account APY is 0.01 percent on balances $1 and higher; the standard APY on the Growth account is 0.01 percent. “Relationship rates” are 0.03 percent APY on balances up to $2,499.99 and 0.05 percent APY on $2,500 and above. To qualify for the relationship rate, you must have at least five PIN or point-of-sale transactions per month using your PNC Visa debit card or PNC credit card, and $2,000 in qualifying monthly direct deposits.

PNC reimburses fees for two non-PNC Bank ATM transactions per statement period. There is no minimum deposit if you open Virtual Wallet online. You must deposit $25 if you open it in a branch. The $7 monthly service charge is waived if you meet one of the following criteria:

- Maintain an average monthly balance of at least $500 in your Spend and Reserve savings account.

- Have at least $500 a month in qualifying direct deposits to your Spend account, such as a paycheck.

- You are 62 or older.

Virtual Wallet with Performance Spend

The checking account with Virtual Wallet with Performance Spend is interest-bearing, paying 0.01 percent APY on balances of $2,000 and up.

The Reserve account pays 0.01 percent APY on balances above $1; the Growth account in this tier has a standard APY of 0.01 percent and a relationship rate of 0.10 percent APY.

There is no minimum opening deposit if Performance Spend is opened online; it’s $25 if opened in a branch. The $15 monthly fee is waived if you do one of the following:

- Make $2,000 in direct deposits to your Spend account each monthly statement period.

- Keep an average monthly balance of $2,000 in checking and/or Reserve.

- Maintain a combined balance of $10,000 in PNC deposit accounts

There is more fee forgiveness with this account than there is with basic checking. The bank reimburses for up to four non-PNC ATM transactions per statement period and up to $10 in other banks’ ATM surcharges.

Video: 7 Things You Should Do Before Claiming Social Security (Money Talks News)

7 Things You Should Do Before Claiming Social Security

Pnc Atm Deposit Cash

Performance Spend also doesn’t charge a fee for paper account statements or cashier’s checks, and there is no charge to redeposit a returned item. There are no fees to request check images and copies of account details if you make the request through online banking. There is an $8 discount on select check designs.

Virtual Wallet with Performance Select

This is the premium account tier with the most benefits. Performance Select includes an interest-bearing checking account. You can have up to six additional linked PNC checking or savings accounts with Performance Select, with no monthly service charge.

The checking APY is 0.01 percent on balances of $2,000 and higher. The Reserve account also pays 0.01 percent APY; relationship rates on the Growth account are tiered, ranging from 0.10 to 0.35 percent APY.

There is no minimum opening deposit if the account is opened online; it’s $25 if opened in a branch. The $25 monthly fee is waived if you meet one of these criteria:

- Monthly direct deposits of $5,000 a month to your Spend account.

- Combined $5,000 average monthly balance in the Reserve account and up to six linked PNC consumer checking accounts.

- Maintain $25,000 combined average monthly balance in linked PNC deposit and investment accounts.

With Performance Select, there is no fee to replace your Visa debit card and there is reimbursement for up to $20 a month in other banks’ ATM surcharges.

There are no fees for paper statements with check images, domestic wire transfers, stop payments or redeposit of returned items. Basic PNC checks are free and there is a $12 discount on select check designs.

PNC checking account fees

Read your account details carefully to avoid surprise fees. Generally, the higher the account tier, the fewer fees you’re required to pay. Unless these fees are waived, here is what you can expect to pay:

- Overdrafts, $36. If your account is overdrawn by $5 or less at the end of the day, overdraft fees are refunded.

- Stop payment, $33.

- Paper statements, $2; with check images, $3

- Cashier’s checks, $10

- Out of network ATM fee, $3; foreign ATMs, $5

- Early account closure, $25 if checking account is closed within 180 days of opening

- Debit card cash advance fee, $3 at PNC ATM; $5 at non-PNC ATM

- Debit card replacement, $7; expedited delivery of card, $25

- Domestic non-PNC bank ATM, $3; non-PNC ATMs outside the U.S., $5

- International purchases and cash advances, 3 percent of transaction amount

- Wire transfers (domestic and international), $15 to $45

- Counter checks, $1.50

- Non-client check-cashing fee, 2 percent of check amount ($2 minimum)

- PNC Express Funds, 2 percent of the check amount over $100; $2 for each check of $25 to $100

- Return of deposited or cashed item, $12

- Requests for images and photocopies, $1 to $5

- PNC Express Funds, which makes deposited money available immediately, 2% of check amount over $100; $2 for each check from $25 to $100.

PNC checking account offers

All PNC checking account customers get a PNC Bank Visa Debit Card and the surcharge-free use of thousands of ATMs. There is also reimbursement of some non-PNC ATM fees, free online banking and mobile banking and higher interest rates on savings as you build your balances. With the PNC Mobile app, you can deposit checks, make cardless ATM transactions, find nearby ATMs, check your balances, set up account alerts and more.

Overdraft protection is drawn from the Reserve and Growth savings accounts and there is no fee to transfer the money. PNC spending and budgeting tools help you track and manage your money. You can set up a budget, schedule bill payments, get alerts when your account is at risk of being overdrawn, set up automatic savings, and more.

PNC checking account customers can earn cash back from participating merchants with PNC Purchase Payback.

PNC customers have access to Zelle, a payment platform that lets you send or receive money from people you trust, regardless of where they bank. You can also make tap-and-go payments using Apple Pay.

PNC checking account promotions and bonuses

Pnc Atm Deposit Maximum

You can earn $50 if you open Virtual Wallet, $200 if you open Virtual Wallet Performance Spend, and $300 if you open Virtual Wallet Performance Select. You are eligible for only one reward amount.

The new checking account must be opened online using the application link on pnc.com/virtualwallet or at a branch before June 30, 2020. A qualifying direct deposit, defined as a recurring deposit of a paycheck, pension benefit, Social Security or some other regular monthly income, must be made within 60 days and your account must remain open.

The reward is credited to the account within 60 to 90 days after all conditions are met and appears on your monthly account statement “Cash Trans Promo Reward.”

Alternatives to PNC checking accounts

If you're not certain a PNC checking account is the best fit for you and you’re comfortable with online banking, check out offers at other banks. There is a plethora of fintech startups, called challenger banks, which typically charge fewer fees than traditional banks with brick-and-mortar branches.

Credit unions are another option, as long as you meet the membership requirements. Membership requirements are pretty lenient at some credit unions. Bankrate's list of the best banks for checking accounts includes a couple of credit unions. You can also find checking accounts with APYs of 1 percent and higher at certain banks.

Featured image by rblfmr of Shutterstock.